Below are graphs showing a strong correlation between financial deregulation, the increase of the credit market, lowered savings rates, income inequality and increasing wages.

Graph of Income Inequality

Graph of American Savings Rate

Graph of Financial Deregulation correlating with Wages in the US

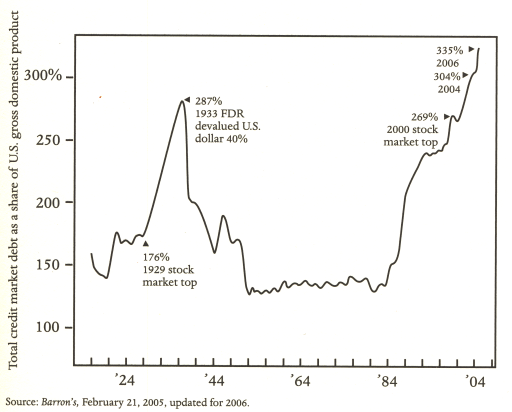

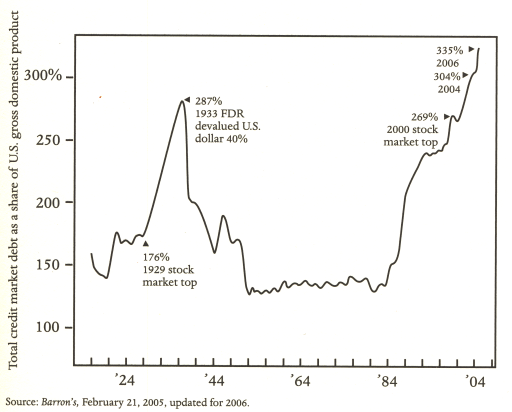

Graph showing rates of Debt relative to GDP

These correlations make a strong argument for good regulation of the financial sector, if only our leaders had the sense to weed out the bad. We must regulate with our eyes open, because not only was there and is there a bubble of housing market and financial sector, but as seen above.. wages. There will be pain as we deleverage to a more stable normalcy, but we have been in a bubble for too long. I am usually not a huge fan of regulation, because usually they are very poorly conceived and sloppily executed... but the financial sector is unique in that, it creates money out of thin air!!!

My current thoughts... stop spending beyond your means, citizen and government!!! In the words of Rick Santelli...

"Stop spending! Stop spending! Stop spending!" -----------------------------Articles

How bad is it going to be? Well, just keep your eye on that total debt versus GDP number. It usually runs around 150%, and at present it's at 350%. The fact is, most of the assets which secure that debt are themselves inflated by the bubble, to the extent that nobody knows what they're really worth. But if you imagine the debt bubble deflating to its historical value, then you're looking at a fall of more than 50% in asset values blown up in the bubble... And because the market for debt-based securities is global, the excesses of the U.S. credit market will afflict financial institutions worldwide.

At the root of every financial bubble is leverage: ...debt.

United States of Inequality

Article 8: The Stinking Rich and the Great Divergence

Who are the Stinking Rich? Their average annual income is about $7 million. Most of them likely work in finance, a sector of the U.S. economy that saw its share of corporate profits rise from less than 10 percent in 1979 to more than 40 percent in the aughts... An explanation of how finance came to take over the U.S. economy would require its own Slate series. But Saez, Hacker, and Pierson argue plausibly that the industry's deregulation (and the protection it received from a few well-placed Democrats like Sen. Chuck Schumer of New York) played a large role.

Two Very important articles in one PDF

This post began as an evaluation of the importance of uncertainty in the marketplace... to touch on this subject (which will probably be taken up in a future blog post) is the article, "Uncertainty bedevils the best system". That is the article that led me to this PDF.

...but the article above it better relates to today's topic and is a great evaluation of the issues. "Cutting back financial capitalism is America's big test". (A common qualm of mine, I hate the title... I think it is abuse of the word "capitalism"... but maybe not. This may have been an irresponsible practice of capitalism.)